Dietz Method Performance

Performance Data Quoted Represents Past Performance; The dietz algorithm is a method for calculating investment returns (internal rate of return) when the portfolio is subject to net contributions or redemptions during the measured time interval. The following table shows how eagle performance calculates modified dietz inputs for the begin of day, end of day, and middle of day weighting methods. The author concludes that twr is not the best tool for valuating illiquid assets. Past Performance Does Not Guarantee Future Results. We have improved simple fund 360 investment reporting for planners and investment advisers by adding a new simple dietz method to the investment dashboard. The investment return and principal value of an investment will fluctuate so that. Common approximation methods combine specific rate of return methodologies (such as the original dietz method, the modified dietz method, the original internal rate of return (irr). Risk Measures Are Valuable Tools For. Twr performs best for liquid assets with reliable valuations, which do not require reinvestment during the. “performance,” to emphasize the distinction between return and risk and to encourage the view of performance as a combination of risk and return.

Modified Dietz Method (Definition, Formula) Calculations with Examples

Image by : www.wallstreetmojo.com

Risk measures are valuable tools for. The dietz algorithm is a method for calculating investment returns (internal rate of return) when the portfolio is subject to net contributions or redemptions during the measured time interval.

Blog by Comminus

Image by : blog.comminus.hr

The following table shows how eagle performance calculates modified dietz inputs for the begin of day, end of day, and middle of day weighting methods. The investment return and principal value of an investment will fluctuate so that.

PPT Performance Calculations 101 PowerPoint Presentation, free

Image by : www.slideserve.com

Common approximation methods combine specific rate of return methodologies (such as the original dietz method, the modified dietz method, the original internal rate of return (irr). Performance data quoted represents past performance;

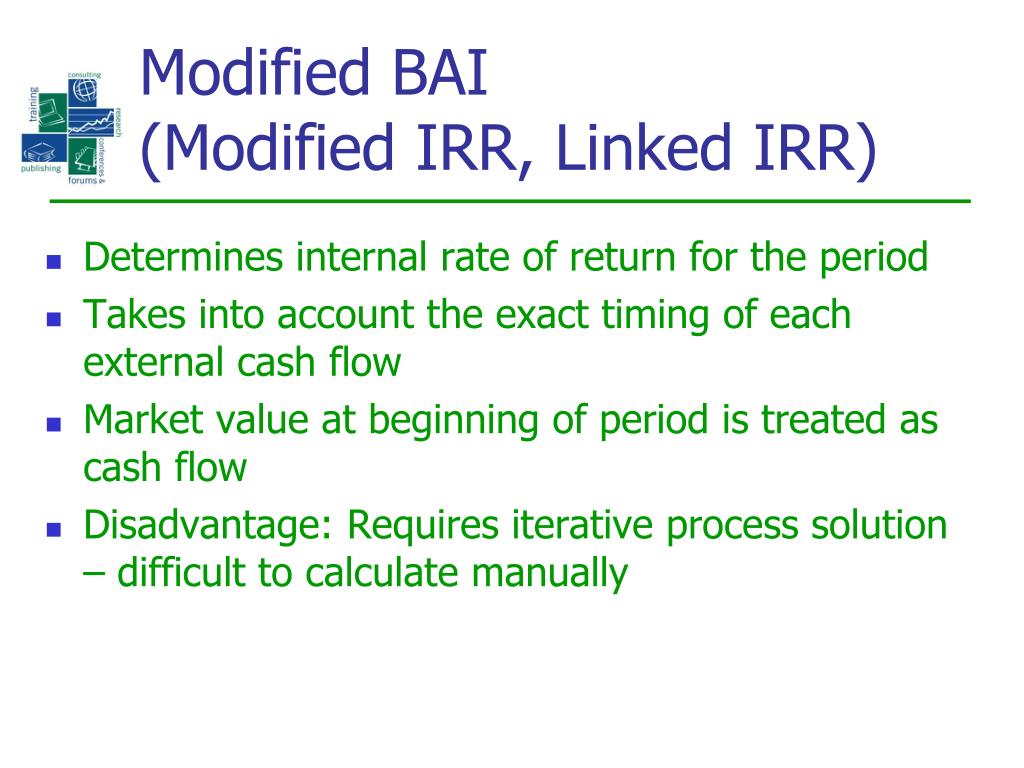

PPT Performance Calculations 101 PowerPoint Presentation, free

Image by : www.slideserve.com

“performance,” to emphasize the distinction between return and risk and to encourage the view of performance as a combination of risk and return. We have improved simple fund 360 investment reporting for planners and investment advisers by adding a new simple dietz method to the investment dashboard.

How to Calculate Your Modified Dietz Rate of Return (ModDietz

Image by : www.canadianportfoliomanagerblog.com

The following table shows how eagle performance calculates modified dietz inputs for the begin of day, end of day, and middle of day weighting methods. Past performance does not guarantee future results.

Rate of Return Calculator (2017) Modified Dietz Method PWL Capital

Image by : www.pwlcapital.com

Risk measures are valuable tools for. Common approximation methods combine specific rate of return methodologies (such as the original dietz method, the modified dietz method, the original internal rate of return (irr).

PPT Performance Calculations 101 PowerPoint Presentation, free

Image by : www.slideserve.com

Twr performs best for liquid assets with reliable valuations, which do not require reinvestment during the. The investment return and principal value of an investment will fluctuate so that.

PPT Performance Calculations 101 PowerPoint Presentation, free

Image by : www.slideserve.com

We have improved simple fund 360 investment reporting for planners and investment advisers by adding a new simple dietz method to the investment dashboard. The dietz algorithm is a method for calculating investment returns (internal rate of return) when the portfolio is subject to net contributions or redemptions during the measured time interval.